Give your clients an underwriting shortcut

Accelerated underwriting just got better

Our accelerated underwriting limits rose to $4 million, making it easier to quickly meet clients' needs.

Use the materials below to learn about our latest update and share the opportunity with clients.

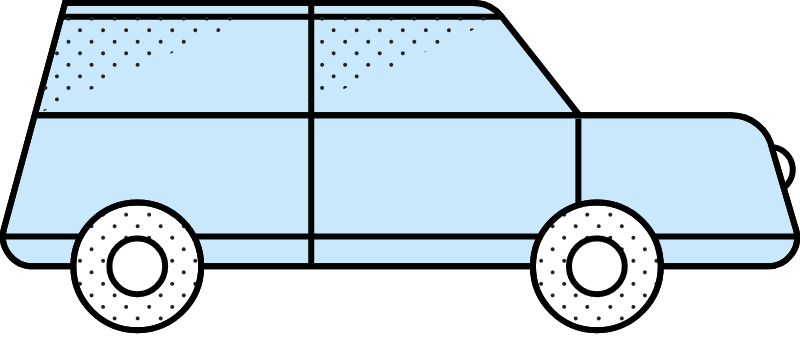

Where the rubber meets the road

Our flexible Underwriting Superhighway adapts to meet the needs of your clients, offering solutions that help provide protection and streamline the decision-making process to deliver results as efficiently as possible.

We don’t expect applicants to be perfect. While others might turn your clients away because of certain medical conditions or financial history, we keep them on the road to a decision.

We leverage advances in medicine, technology and data utilization to improve, enhance and accelerate the risk-selection process.

- Ways we can make applying easy

- Digital application

- Advisor-Assisted application

- Digital AppAssist with a client interview

First stop, Instant Decision

We pride ourselves on delivering instant decisions, helping you save time and provide clients with quick, clear answers to their applications.

While completing the application, we run health and other background checks. Through computer-generated data and predictive analytics, decision-making technology evaluates risks and guides the decision.

Efficient process

Efficient process

Our advanced underwriting process helps provide accurate, real-time decisions. When additional review is required, the process is designed to move swiftly, ensuring minimal delays and maximum transparency for you and your clients.

- What information do we utilize for an Instant Decision?

- Age

- Weight/height

- Social Security number

- Lifestyle habits (driving history, international travel, occupation, tobacco use, etc.)

- Financial information (annual income, credit history, etc.)

Skip the exam

We simplify the underwriting process by skipping the need for an exam for qualified applicants.

Exam-free

Exam-free

Our exam-free option eliminates the need for an exam. Eligibility is based on application information and third-party data, making the process faster and easier for everyone involved.

- Accelerated underwriting options

- No exam or APS

- APS only

- EHR only

The last mile

Some clients may require full underwriting, which can involve ordering further requirements. Our team will reach out to keep you informed along the way. This process ensures we can provide the best possible coverage options tailored to meet unique client needs.

Our mission

Our mission

At LGA, we want to protect more families and businesses through life insurance. We’ll work with you to do everything possible to offer protection for your clients.

Why term life insurance?

Why term life insurance?

No other national life insurer offers more term life options than LGA. Our products provide the best financial protection for meeting short-term needs like paying debts, replacing income and covering expenses.

- Why LGA?

- #1 US brokerage term life insurance provider based on new coverage*

- $1B in claims paid every year

- 4,100+ families and businesses across the country were beneficiaries of Legal & General America policies in 2024**

Details at a glance

Review the ways we can get your clients a quick underwriting decision in the chart below or learn all about LGA underwriting here: https://www.lgamerica.com/advisor/our-approach/horizon-experience.

Frequently asked questions

We get it. Underwriting gets our wheels spinning too. So let’s review a few topics that people usually want to know more about.

Exam-free: As little as 10 days with sufficient EHR.

Full Underwriting: As quickly as two weeks, depending on receipt of necessary records and exams.

Over 68% of cases will have decisions in 10 days or less.

Those still on our Underwriting Superhighway might still qualify for our exam-free shortcuts.

Those continuing on the Underwriting Superhighway can still qualify for our Lab-Only Decision or move onto Full Underwriting.

Our underwriting field guide

From our underwriting philosophy, sweet spots, and programs to detailed information on underwriting criteria across every class, learn more about how we underwrite individuals, not impairment.

Partner Dashboard is your self-service solution

Manage your business, organize your applications, and access all the tools you need from a central location.